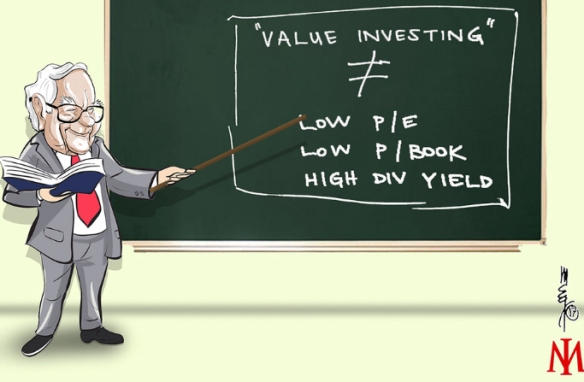

Value investing is one of the most succesful ways to approaching investing of all time.

Since Benjamin Graham set the rules of this way of investing with his well-known book «The Intelligent Investor» many people in the investing market have followed his teachings

Nowadays with the boom in the crypto market we can profit from several principles established by

Value investing in the cryptocurrency market? 6 principles to consider

1. Look for intrinsic value.

Unlike what many people think, many cryptocurrencies have many projects that are either already working or are very promising for the future. Investing in cryptocurrencies should not be simply an investment in the form of speculation without any real basis, that is the direct way to failure.

Any cryptocurrency investor should deeply analyze the cryptocurrency in which he/she is willing to invest his money: Who has created it? What blockchain technology does it use? Is it a currency of limited or unlimited circulation? What problems does it solve? What does it present in its founding whitepaper? How many users, developers, institutions and investors trust this cryptocurrency? Is it a centralized or decentralized cryptocurrency? Is there any investor or investors that have an excessive control (+5%) of all the cryptocurrency circulation?

At the very least, I believe that cryptocurrency investors should clearly answer these questions before investing in a particular cryptocurrency. Moreover, these answers will help us to see how much of the value of that cryptocurrency is pure speculation» or genuine intrinsic value

2. Avoid excessive risk.

Warren Buffet once said: There are only 2 rules for investing, the 1st: Never lose money, the 2nd is to never forget rule number 1.

It is true that in the cryptocurrency market there is a much higher risk in general than in the stock market because it is a very young market with little regulation, but that does not mean that excessive risks cannot be avoided.

For example I personally, I have the principle of never investing with leverage, which means you take capital from money that you do not have to multiply the amount with which you invest, for example if you invest 100$ and your leverage is at a ratio of 1:100 you would be artificially operating with 10. 000, if you make a profit you can win a lot but if you lose you will have a very big debt with your broker, so it is a risk that for me is not worth undertaking.

Afterwards, the investor in cryptocurrencies should not risk everything in unknown altcoins that despite having very interesting projects for the future have not yet demonstrated anything, then he should invest money that he is absolutely willing to lose, not money that you need in case you lose money.

3. You have to understand what you invest in.

This point is paramount. If you do not understand the fundamentals and functioning of cryptocurrencies in general and the one you choose specifically, I would not recommend you to invest anything at all.

The key to value investments is to make an extensive analysis of the product in which you will invest money, if you do not understand well how it works it is impossible to choose assets that you believe will be profitable in the future and you will simply rely on what feel or in what you believe in a not very rational way so you will surely have worse results.

4. Don’t think in weeks or months; think in years or decades:

The greatest investors who use the fundamental analysis method invest for long periods of time unless there is some very unexpected factor that forces them to sell. It is true that talking about decades in a market as young as the cryptocurrency market, which has not been around for more than 12 years, can be strange.

But if you really believe that cryptocurrencies (as a technology and a decentralized finance method) will play a key role in our future, why not be a pioneer and invest now?

Obviously many currencies will fail, others will remain and new ones will appear with more innovative technology that will dominate various sectors of the market so it is difficult to choose just one cryptocurrency. But if you believe that these new digital assets will have an important share in our future, why not diversify among several technologically promising cryptocurrencies?

5. Do not accept anything without first questioning everything.

Fundamental asset analysis is about searching, analyzing and asking questions all the time about why that asset really deserves your money. When using this type of investment we cannot fall into the temptation of simply trusting the cryptocurrency for no apparent reason because we like it, you have to ask yourself why it works? Why would someone invest in this one and not in another?

6. Trust data, not emotions.

If you use the fundamental analysis method, data will be the key to make the final decision.

Although it is true that the foundations of this way of investing were established more than 70 years ago and at that time the concept of «cryptocurrency» seemed absolutely unthinkable, following these principles has been useful up to the present day and I have no doubt that it will continue to be so for a very long time.